The existing financial system is very beneficial to the wealthy class; of course, they do not understand cryptocurrencies.

Translator's Note#

This article is suitable for beginners in cryptocurrency as well as advanced learners. It fairly introduces the core characteristics of cryptocurrencies in a shorter format, then leads into the necessity of cryptocurrency systems by discussing the risks and flaws of the existing monetary system. Without much technical jargon, it guides readers through the macro perspective of the crypto world and financial systems from a finance/economics standpoint.

Some slang and technical terms will be annotated by the translator at the bottom of the paragraphs. Additionally, I will provide annotations for viewpoints I consider biased and points that may be difficult to understand in the Chinese context. I hope everyone has a pleasant reading experience.

Premise of the Work#

Since the launch of Bitcoin in 2009, cryptocurrencies have rapidly risen, but most people still do not understand why cryptocurrencies exist and what their potential is. In my experience, this question is most acute among the educated and relatively wealthy populations. Compared to other demographics, the wealthy find it difficult to comprehend the severe flaws of the existing financial system and cannot grasp what value cryptocurrency technology can provide. If a system is very effective for a specific group, they have no reason to understand alternatives, let alone seek them out.

This article provides a simple introduction to cryptocurrencies and explains the "why" of emerging technologies at a (very) high level. While this article may not convince you that cryptocurrencies are just a bubble, even the most fervent crypto skeptics should gain a greater understanding of cryptocurrency technology and its potential future applications.

If you need further persuasion, believe me when I say that crypto is the most profound innovation since the internet. Everyone should at least be familiar with the reasons for the adoption of crypto technology, especially the wealthy. After all, you wouldn’t want to be left behind, would you? :-)

Introduction: What is Cryptocurrency#

Cryptocurrency is a specific application of blockchain technology. Blockchain technology can be viewed as a digital ledger. A block is a collection of data, typically transactions in the case of cryptocurrencies. Depending on the system's design, a new block is added to the digital ledger, or blockchain, at regular intervals. The blockchain is essentially a "sequence of bills" that linearly preserves the recorded transaction history.

Cryptocurrency is a blockchain used to facilitate value exchange. Bitcoin is the earliest and most famous cryptocurrency. Simply put, the Bitcoin blockchain is a digital ledger used to track who owns how much Bitcoin. (Note: capital B Bitcoin refers to the Bitcoin network; lowercase b bitcoin refers to the cryptocurrency Bitcoin). Bitcoin is programmed to only ever exist in a total of 21 million coins, often considered a digital store of value or digital gold, which is a Lindy value-storing asset.

Translator's Note: "Lindy value-storing asset" refers to assets that exhibit the Lindy effect, which states that for some things that do not naturally die out, such as a technology or an idea, their expected lifespan is proportional to the time they have already existed. That is, the longer they survive, the longer their remaining expected lifespan increases.

The most profound innovation of Bitcoin is its consensus mechanism - Proof of Work (PoW). A highly simplified PoW consensus is a process in which a network of computers competes for the right to validate blockchain transactions. Under PoW, each computer that validates transactions is called a "miner." As a reward for their efforts, miners receive cryptocurrency rewards from the network, or bitcoins from the Bitcoin network. As an open-source protocol, anyone can add their computer to the Bitcoin network and verify the authenticity of Bitcoin transactions since its launch in 2009.

So far, this is very simple. But you might be thinking, "So what?"

"So what?" The design of PoW allows for the development of a vast network of independent participants. As more funds enter the network, the price of Bitcoin rises, incentivizing more miners to join the network. As more miners join the network, trust in the network increases, leading to more funds entering the network, and so on.

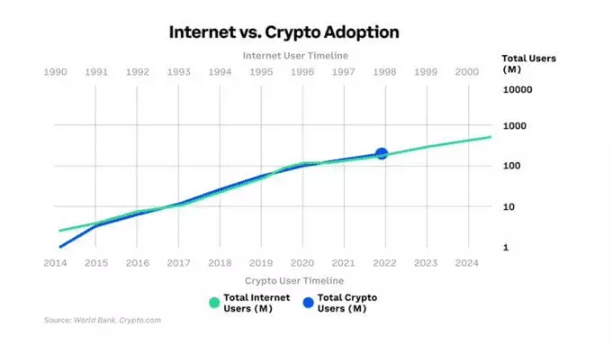

This elegant incentive mechanism creates a massive network of independently operated computers dedicated to maintaining a simple ledger of Bitcoin transactions. Since its launch in 2009, the Bitcoin network has grown rapidly, with over 100 million individual Bitcoin owners, an estimated 1 million miners, and a market capitalization of around $400 billion, making it the 17th largest asset globally. The speed of Bitcoin's adoption is comparable to that of the early internet.

Let’s recap what has happened.

In a completely unorganized manner, over 100 million active participants have been attracted to join the Bitcoin network for various reasons. This is an activity without any centralized authority involved, no government, and no coercive factors. Simply due to the code and simple incentives, Bitcoin has successfully allowed individuals from around the world to slowly form a network comparable in size to that of nation-states for long-term cooperation and coordination, generating exchange value in the process.

When you think about it, it’s truly incredible.

The second-largest cryptocurrency by market capitalization is Ethereum, which builds on Bitcoin's consensus innovation but introduces programmability. Ethereum is a cryptocurrency with smart contract functionality. Smart contracts on Ethereum allow users to sign agreements over the internet and execute them through code, rather than being limited to the single application case of managing Bitcoin transactions like the Bitcoin network. For example, on Ethereum, you can borrow money on the lending platform Aave, swap one asset for another using the automated market maker Uniswap, or purchase an artwork or avatar on the NFT platform OpenSea.

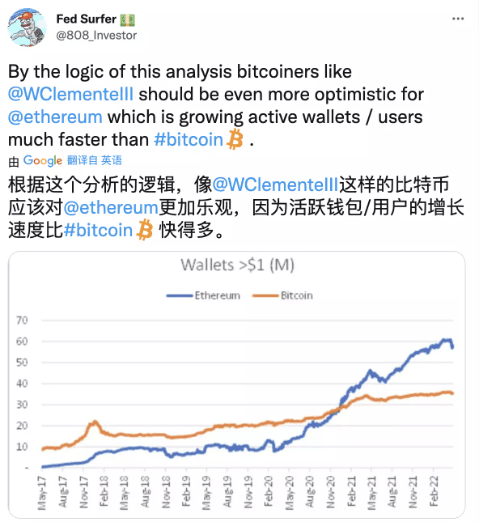

While it may be early days, with Ethereum, you can see the potential for a global financial system based on the internet; a system without borders, accessible to anyone via the internet, and one that does not involve third parties taking a cut from every transaction. Notably, Ethereum is developing even faster than Bitcoin; although it is over six years younger than Bitcoin, its number of wallets is nearly double that of Bitcoin (Ethereum launched in 2015).

I hope you are starting to see the importance of cryptocurrencies and some potential use cases, such as value exchange.

To further emphasize a few key points, as decentralized public chains, Bitcoin and Ethereum are:

- Trustless: They do not require a centralized authority to coordinate the participation of two or more parties.

- Censorship-resistant: Thousands of active participants around the world independently maintain these networks. Therefore, companies, individuals, and governments can hardly prevent anyone with internet access from accessing the protocol.

- Secure: In the case of Bitcoin, to attack the protocol, one would need to control 51% of the network, which I estimate would require at least around $8 billion in computer hardware, not to mention tens of billions of dollars in funds and years of careful preparation to make the necessary infrastructure investments.

In short, Bitcoin and Ethereum are public blockchains that anyone in the world can access without an administrator, and without worrying about hostile participants seizing your property.

Translator's Note: The original author refers to the security brought by the immutability of blockchain in a broad sense, but in practical scenarios, there are still hacker behaviors such as phishing attacks and backdoor attacks by malicious attackers.

This is a big deal! Before the advent of crypto technology, humanity needed a government to enforce such a vast globalized system.

For the wealthy among us, this is a great opportunity to understand this technology on a higher level and recognize that many people choose to participate in it. But you may still be highly skeptical. If you are such a person, you might think the current system works just fine. But what does that really mean?

Let’s start with currency and explore the current paradigm to better understand how cryptocurrencies provide an interesting alternative to the existing financial system.

Fundamental Flaws of the Fiat Currency System#

In reality, the current fiat currency system, centered around the dollar as the global reserve currency and the permanent deficit spending of Western governments, is unsustainable. In our lifetime, other alternatives will emerge. And government currencies with deficit spending, like the dollar, will depreciate significantly over the coming decades. Given this possibility, individuals must be cautious to protect themselves from currency devaluation. Cryptocurrencies, especially Bitcoin, offer an interesting solution to this dilemma.

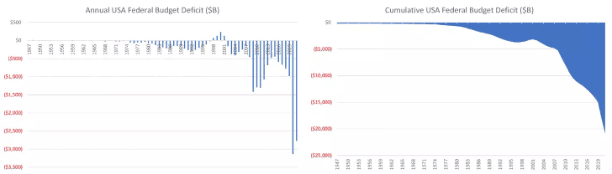

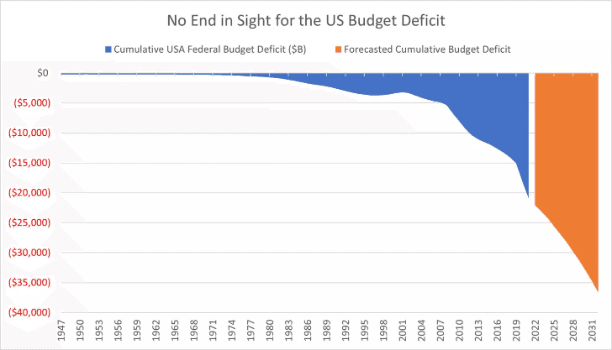

Since the Nixon administration officially ended the Bretton Woods system that pegged the dollar to gold, the U.S. federal government’s budget has been in a severe negative state. The petrodollar system that emerged in the 1970s made the dollar an effective global reserve currency. As the global reserve currency, the demand for dollars has exceeded what can be reasonably justified by the size of the U.S. economy, allowing the U.S. to consume more than its income without significantly depreciating the dollar. The U.S. has taken advantage of this situation, leading to an accumulated deficit of over $20 trillion. The trend is essentially #UpOnly.

Translator's Note: #UpOnly is a Twitter hashtag meaning "up all the way" or "one-sided increase."

The U.S. Deficit is #UpOnly:#

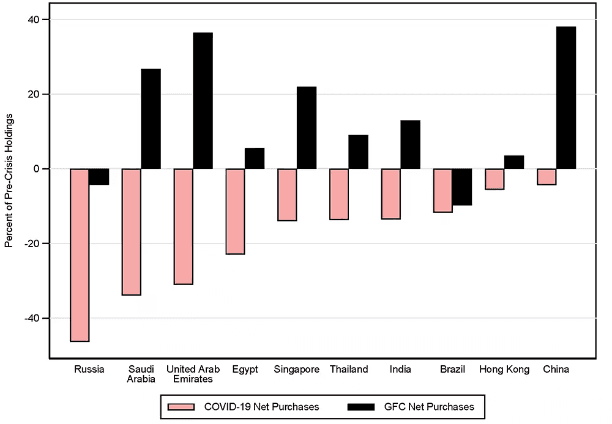

Starting in 2009, during the Global Financial Crisis (GFC), U.S. government spending began to surge. Since then, foreign demand for U.S. government bonds has been shrinking. As shown in the chart below, this issue worsened during the COVID crisis. Other countries are increasingly reluctant to allow the U.S. government to spend recklessly.

* Country-wise breakdown of government bond purchases: the largest buyers during the Global Financial Crisis were net sellers during the COVID-19 pandemic.*

To fill the gap left by foreign buyers exiting the U.S. bond market, the Federal Reserve began purchasing bonds from the Treasury, a process known as quantitative easing (QE). Quantitative easing can be seen as the government printing money to finance itself rather than raising taxes or cutting spending. Printing money through QE has proven to be a more popular solution for financing government spending than the austerity measures taken by Greece after the Global Financial Crisis.

For visual learners, here is a visual representation of quantitative easing:

As the largest buyer of U.S. government bonds, the Federal Reserve kept interest rates very low after the Global Financial Crisis, allowing the government to finance itself at favorable rates (i.e., cheap debt). On the other hand, with cheap financing, the U.S. government has no incentive to address the structural issues of the federal budget. Due to generous welfare programs like Social Security and Medicare, as the elderly population in the U.S. grows larger than the working-age population, government spending has been growing faster than tax revenue for decades, thus increasing the tax base.

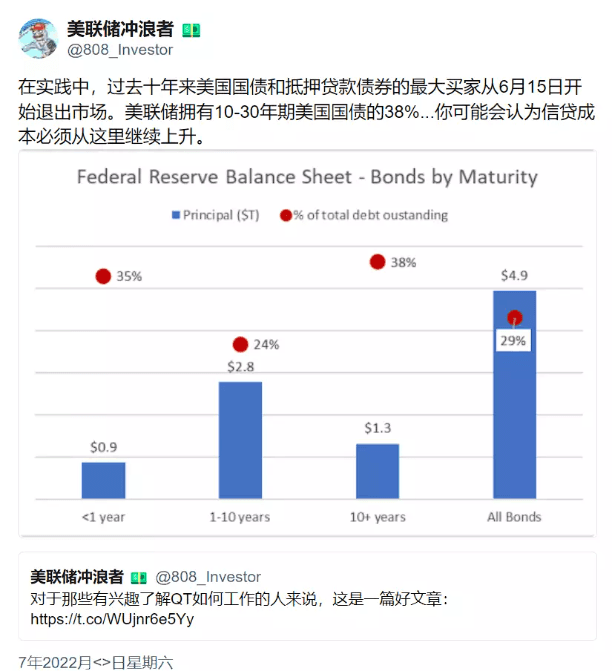

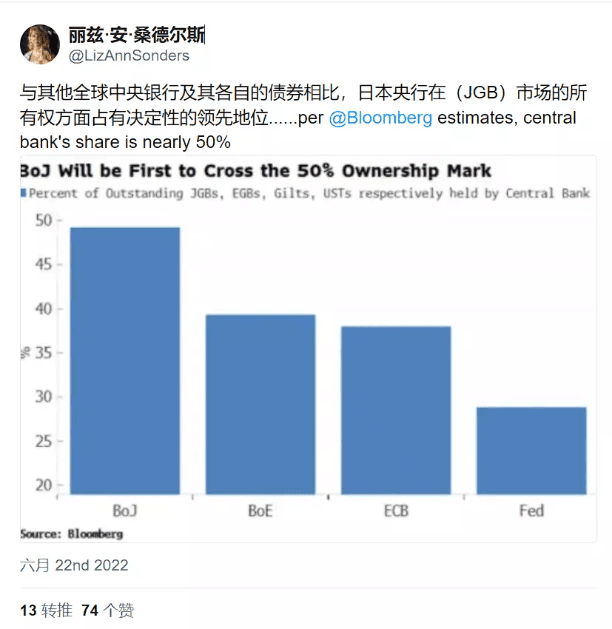

Over the past decade, the Federal Reserve has become the largest holder of U.S. government debt, accumulating about 40% of long-term government bonds. Recently, the Fed was forced to reverse its quantitative easing policy to control inflation caused by extreme money printing during the COVID crisis, when the U.S. government’s money supply grew by about 40%. The process of quantitative tightening (QT) is the opposite of quantitative easing: the Fed stops buying government bonds, and the money supply contracts. The Fed began signaling the impending QT to the market in November 2021, leading to a sharp rise in government bond yields and a significant sell-off of risk assets like cryptocurrencies.

The U.S. government and the Federal Reserve face a serious problem. If the Fed relies on the free market to fund the U.S. federal government’s deficit, the government’s debt rates could potentially be far higher than for most of the past decade. Keep in mind that the Fed has purchased about 40% of the federal government’s outstanding long-term debt. This demand for at least 40% of government bond issuance must be replaced, and one of the largest sources of demand, foreign governments, do not want to fund U.S. government spending. These are huge demand gaps that need to be filled.

If interest rates rise, the government’s spending capacity will be negatively impacted in two ways. First, higher interest expenses lead to larger government deficits (thus issuing more bonds). Second, more adversely, as debt costs rise leading to an economic slowdown, rising interest rates lead to declining tax revenues. For a debt-driven society with increasing citizen debt, an economic slowdown is a disaster.

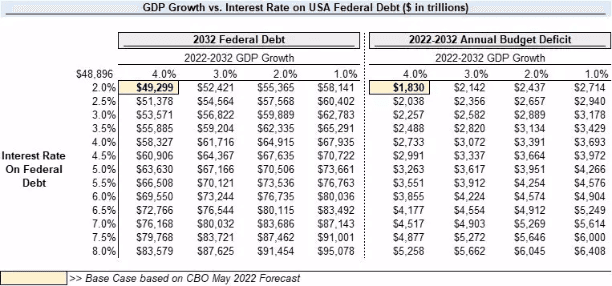

By 2032, the federal government will need to fund at least $1.5-2.0 trillion in deficits annually. This problem will worsen in the context of rising interest rates and slowing economic growth.

The U.S. has a massive deficit problem; the situation will only worsen with rising interest rates and slowing economic growth.#

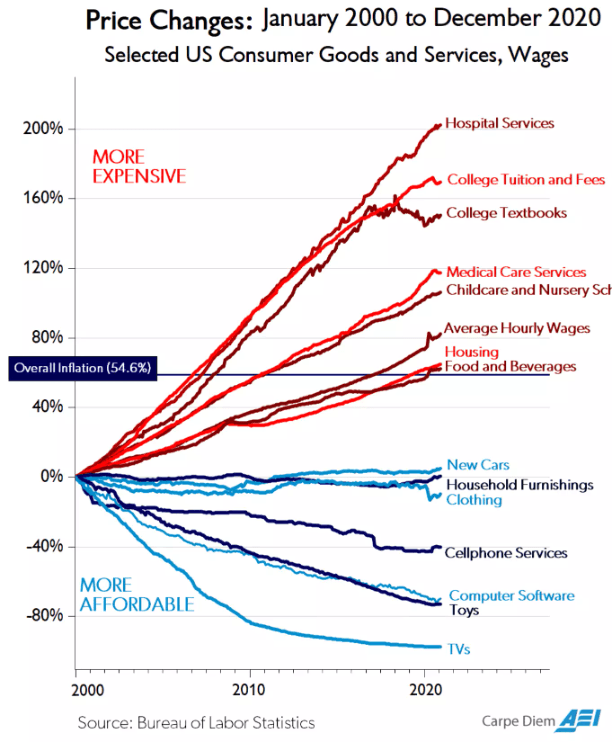

This long-term deficit system of the U.S. government imposes significant costs on ordinary Americans. As the government increasingly controls Americans' purchasing power, the share of politically favored sectors like healthcare, education, and housing in the average American's wallet is also increasing:

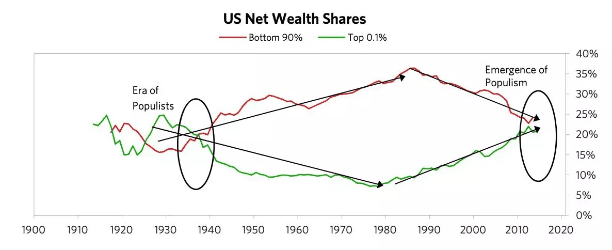

Moreover, rising asset prices and declining purchasing power of the middle class have led to an increasing share of wealth enjoyed by the wealthiest Americans. As ordinary people compete for an ever-shrinking pie, there is little incentive for those in power (the government and the wealthy) to change the existing system.

While the fiscal situation in the U.S. is concerning, many other countries are in even worse situations.

Japan foreshadows what the U.S. fiscal situation may look like in the near future. The Bank of Japan owns nearly 50% of its own bonds. The Japanese government seems determined to find out how much it can finance the Japanese economy before yen holders realize that the yen is not scarce at all and is essentially worthless.

Developing countries like Turkey, Argentina, and Venezuela have not benefited from strong economies or reserve currency status but instead consume beyond their means, suffering from shockingly high inflation and persistent currency crises, with the living conditions of their citizens deteriorating year by year.

For billions of individuals subject to irresponsible government monetary policies, Bitcoin offers a potential and attractive alternative to the increasingly unstable fiat-based system.

Most obviously, Bitcoin provides verifiable scarcity. Thanks to programmability, Bitcoin is programmed to only ever exist in 21 million coins. Because the blockchain is decentralized, no one can change the number of Bitcoins, and no government can reduce the purchasing power of a single Bitcoin. Given the choice, it is easy to understand why someone would choose to hold a verifiably scarce digital asset like Bitcoin rather than a local currency that depreciates by double or even triple digits each year.

Translator's Note: The purchasing power of a single Bitcoin means that, regardless of circumstances, 1btc=1btc. Fiat currencies do not meet this condition; for example, $1 in 1950 cannot be compared to $1 in 2022, describing the depreciation caused by currency inflation.

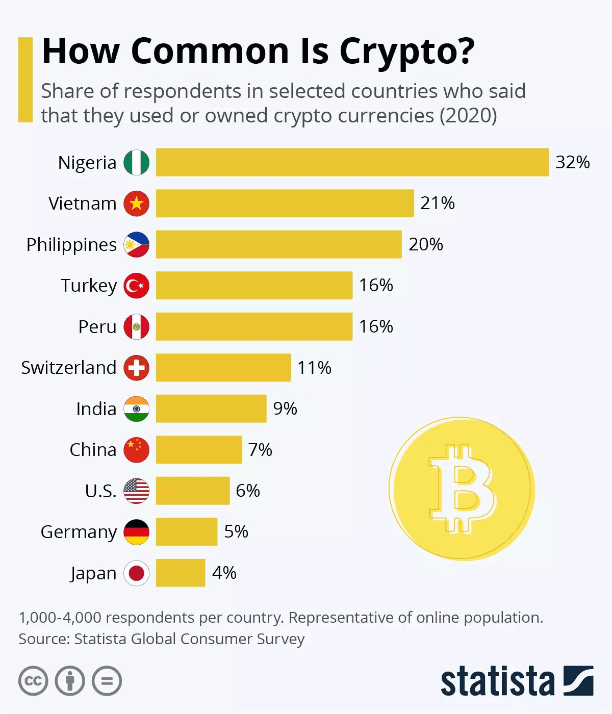

In fact, the highest acceptance rates for cryptocurrencies are in developing countries. According to Statista, Nigeria, Vietnam, and the Philippines are the top three countries with the highest cryptocurrency acceptance rates, with 32% of Nigerians using or owning cryptocurrencies. Nigeria has reported inflation rates ranging from 10-20% over the past decade. Frankly, the purchasing power of Nigerians is decreasing by 10-20% each year. Meanwhile, Bitcoin's purchasing power has increased several times over the past decade. Which economic system would you prefer?

Clearly, individuals are choosing cryptocurrencies. There are also increasing reasons to believe that entire nations may soon consider alternatives to traditional assets to protect their wealth.

In February of this year, the U.S. cut off Russia from the SWIFT system. The Society for Worldwide Interbank Financial Telecommunication is a global payment network that facilitates trade between international financial institutions. The U.S. effectively severed Russia's connection to the major technological infrastructure for global trade. To further increase pressure, reports emerged this summer that the EU is considering banning gold imports from Russia.

Historically, the U.S.-led Western financial system has been the most trusted due to relatively stable governments and strong legal protections. Gold has always been the reserve asset of the gold standard: scarce, and seemingly without counterparty risk (gold cannot go bankrupt). Recent events have highlighted the inherent risks of storing wealth within a system controlled by Western countries. More and more major nations are looking for alternatives.

Bitcoin has several characteristics that make it an interesting alternative to traditional reserve assets like paper currency, sovereign bonds, and gold.

Bitcoin is completely independent and has no counterparty risk. The Bitcoin network is a collection of thousands of individuals running the network across dozens of countries worldwide. All a country needs is one node and an internet connection, and they can immediately access their wealth. With the increase in the dollar supply, a country does not need to worry about counterparty devaluing its asset value like the U.S. does every year. A country does not need to worry about a counterparty eliminating their access to their property, as the U.S. did by cutting off Russia's access to the SWIFT system.

The current fiat-based paradigm is plagued by human unreliability. Mathematically, the problem of permanent currency devaluation seems to worsen. Therefore, individuals face the risk of actual wealth accelerating outflow. Meanwhile, countries are increasingly aware of the risks associated with participating in a U.S.-controlled monetary system. Cryptocurrencies, especially Bitcoin, offer individuals and nations an interesting and potentially increasingly attractive alternative currency to replace the fiat-based monetary system.

Now that we understand the fiat system and its inherent unsustainability, let’s explore the issues within the financial system, which have largely gone unaddressed, especially for the wealthy, for whom this system is relatively (more) favorable.

Fundamental Flaws of the Financial System#

Most people can understand the appeal of Bitcoin and "digital gold," as public awareness of currency devaluation has increased following quantitative easing policies. However, what the wealthy truly struggle to understand is how to explain and comprehend the potential of Ethereum and decentralized finance ("DeFi") as alternatives to the existing financial system. The current system works well for most people, so what needs improvement?

The design of the modern financial system has always revolved around the idea of one or more trusted third parties. You put your money in a bank like JPMorgan and take out a mortgage. You store stocks with an online brokerage like Charles Schwab. You pay for groceries and other essentials with a Mastercard credit card. You can pay bills or your friends using financial apps like Cash App or Venmo. You can send money to relatives abroad using remittance providers like Western Union. Everything usually goes smoothly. Have you ever thought about what you are giving up for such arrangements?

It turns out, a lot.

Think about what it takes to access these services. You need to provide every detail about yourself. You have to wait days for approval. If you have bad credit, they can deny you. If you are not a U.S. citizen, good luck even getting started. Assuming you can register, you may only be able to access services during certain narrow time frames, like banks (9-5, forget weekends and holidays) or brokerages (market hours).

Then there are the friction costs. Want to switch brokerages? Think about how painful it is to change brokerages. If you are leaving the country, your bank or broker will likely treat you like a terrorist (to be fair, it’s not their fault, as the government requires them to do so). If you are a cash-strapped small business, it can take days or even months to finally receive funds from a transaction. This is far from ideal.

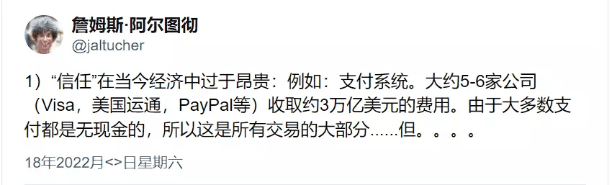

Finally, there’s the cost issue. Banks earn a 2-3% spread for holding your money. They pay you 0% and then lend it out at 3%, 4%, or even 5%. Nice. Brokers like Charles Schwab earn profits from the mutual funds they sell you or the securities you store with them. Credit card issuers like Capital One and payment processors like Visa take 2-3% from any debit or credit card transaction. Remittance agencies like Western Union charge over 5% for the privilege of sending money outside the U.S.

Why does all this cost so much? Because it’s a combination of rent-seeking and trust. Banks benefit from FDIC insurance subsidies, which essentially ensure they will be the primary place to store cash. With the help of banks and the government, payment processors have monopolized the technological channels we use to move funds. Various government regulations and technical standards make cross-border remittances complex and expensive, especially for small amounts. We trust these systems mainly out of habit, without questioning the necessity or cost of such arrangements.

What if we could create a system that retains all the trust of the existing system while eliminating rent-seeking?

With Ethereum and other blockchains that enable smart contracts, we can.

Today, you can store your wealth in a digital wallet on the Ethereum blockchain, which you can access from anywhere in the world at any time. There are absolutely no bank hours, border restrictions, or other unnecessary friction costs. All you need is an internet connection and a browser like Chrome.

Want to earn some yield on your cash? Head to Aave, a decentralized lending market, and deposit some funds. Aave currently pays 1-2% on stablecoins (i.e., digital dollars), while only earning a thin margin of 10-15% from depositors. Good luck to banks having to compete with that in the future.

Want to swap some of your cash for tokens of another protocol? Go to Uniswap to purchase tokens of a promising new project.

Need a loan? Head to MakerDAO, deposit your Ethereum, and withdraw some stablecoins (i.e., digital dollars). You might be surprised to find that individuals have been lending and borrowing with their crypto assets online completely without permission, purchasing real-world assets like pianos or even houses.

Want to pay a merchant for a cup of coffee? Use your Phantom wallet on the Solana blockchain with USDC stablecoin to pay your local barista in seconds, with each transaction costing less than a penny. No need to pay a 3% fee to a credit card company. No waiting days or even weeks for the merchant to receive the funds.

In all of the above examples, you can:

- Access them in seconds, from anywhere in the world. All you need is an internet connection, a browser like Chrome, and a MetaMask wallet to use these applications. No need to share your identity or wait for someone else to approve you. The service is available to you in seconds.

- Instant settlement. No waiting for banks to approve your loan or settle your stock trades. Funds can be in your hands within minutes.

- It’s cheap. Current transaction fees on Ethereum are $1-2, making payments over $100 competitive with credit cards. Comparable smart contract platforms like Solana or Polygon are even cheaper and faster, with transaction costs of just a few cents.

In short: blockchain-based systems are more accessible, cheaper, and have less friction. More access, less friction, and lower costs are typically a powerful combination in the tech space, just as Google’s ads and media, Amazon’s retail, or Apple’s phones have shown to traditional industries.

Before we assume a utopia without the quagmire of traditional financial systems, it’s important to be realistic: this technology has a long way to go before it enters a golden age. The current user experience is poor. In the real world, it is nearly impossible to use cryptocurrencies. Regulatory treatment of cryptocurrencies remains very ambiguous.

The biggest challenge facing cryptocurrencies may not even be technical, but rather consumer behavior. Transitioning from using third-party services to manage your wealth to self-custody is a huge shift. As 1.5 million paid customers of AOL would tell you, consumer behavior is super sticky. I wouldn’t expect the baby boomer generation to dive headfirst into a blockchain-based public financial system.

Translator's Note: The baby boomer generation refers to those born during the post-World War II baby boom, from 1945 to 1965. Here it refers to people from the old money era.

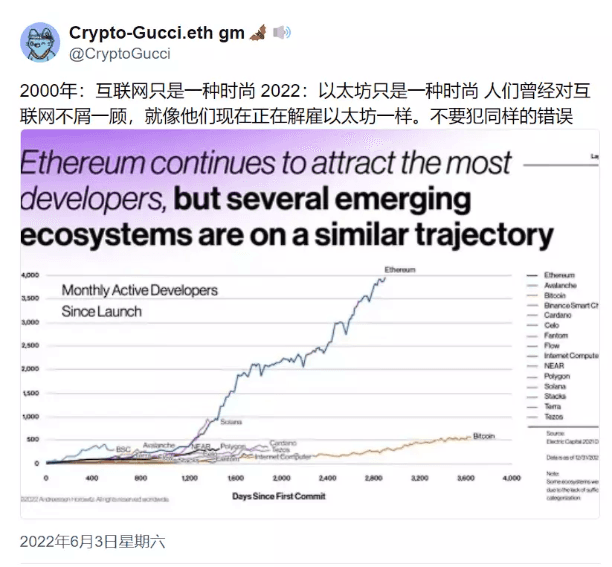

But like the early days of the internet, cryptocurrencies represent a zero-to-one technological leap over the existing financial system. The word is getting out: thousands of software developers are flooding into the space to capitalize on this potential once-in-a-lifetime opportunity:

Thousands of entrepreneurs and an increasing number of people interested in crypto technology will solve various problems facing crypto technology. As these problems are solved, individuals may increasingly choose to enter the cryptocurrency financial system and cut out the intermediaries that dominate the existing financial system.

Conclusion#

Currently, fiat-based systems are generally functioning well. Billions of people are able to exchange goods and services every day. This system is also very sticky. Habits and regulations, such as government requirements to pay taxes in local currency, make it extremely unlikely that an alternative financial system will emerge overnight.

What is more likely to happen is that, while the share of digital assets like Bitcoin and Ethereum continues to increase in global net worth, individuals will continue to choose to enter a new internet-based economy. Compared to the existing system, an independent, internet-based financial system offers too many benefits, and it is unlikely that we will see greater applications of cryptocurrencies for many years to come.

Translator's Note: The author categorizes the financial system into three classes: traditional finance, internet finance, and decentralized finance. This paragraph means that due to the poor experience of decentralized finance, more people will choose to enter internet finance.

Additionally, there are speculative cycles. The cryptocurrency asset class has performed the best in history. Bitcoin has risen 230% annually over the past decade. Ethereum has increased over 2,000 times since its initial token offering in 2014. However, it is still early days for wealth to shift out of the traditional fiat-based financial system. The total market capitalization of cryptocurrencies is $0.9 trillion, while global assets are approximately $500 trillion. In the long run, especially as the world becomes increasingly digital, it is not an exaggeration to think that the world may collectively store 1-10% or more of its wealth in cryptocurrency assets. Future cryptocurrency cycles will continue to drive technological development and attract a new batch of risk-seeking adventurers (for example: me, a student in 2021).

Therefore, even if the existing system works well for you and you are a cryptocurrency skeptic, it is necessary to understand and appreciate cryptocurrencies as a potential technological wave that may be greater than the internet. In the coming decades, cryptocurrencies may only grow stronger.